DIwali Muhurat Trading 2024 is coming up, so mark your calendars! On November 1, 2024, from 6:15 PM to 7:15 PM, there will be a special one-hour trading session. In a period typically linked to riches and success, this is a fortunate time to participate in the Indian equity market. Get your investment plan ready now to take full advantage of this important cultural trading event.

Muhurat Diwali Trading 2024

A special event known as muhurat trading takes place on the Indian stock exchanges on Laxmi Pujan, the day of Diwali. Taking place in the evening, this unique trading session lasts only one hour. For traders and investors, it offers a rare chance to engage in the market during a period considered favourable for investments.

Diwali is a festival that represents the triumph of good over evil and light over darkness. People typically invest in a variety of assets, such as stocks and mutual funds, during this joyous time. Many people think that investing now increases the likelihood of building wealth. Muhurat trading is a much-anticipated event, with the stock exchanges announcing the timetable each year.

Muhurat Trading date and time

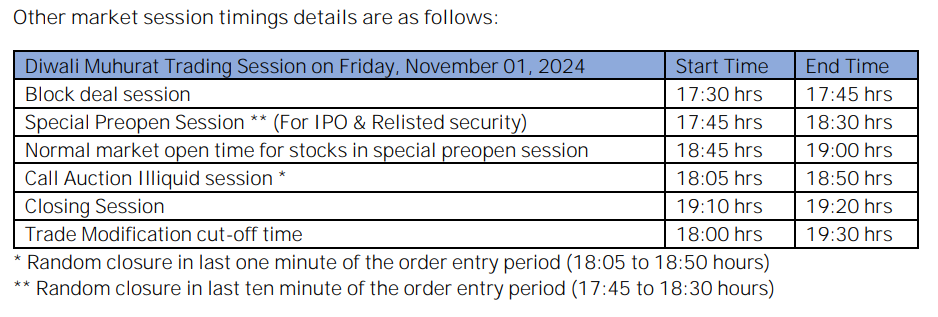

The stock exchanges specify the time of Muhurat Trading for every year. Muhurat Trading session 2024 will be held on Friday, November 1. The special trading session will be held from 6:00 pm to 7:00 pm. The stock exchanges also conduct a 15-minute pre-open session starting 5:45 pm. The trades taking place during the special trading session are also settled on the same day.

New Investments on Muhurat Trading’s Occasion:

Muhurat trading is thought to be a great opportunity to invest. This is a great time to invest in the stock market if you’re thinking about doing so. The market is typically bullish during muhurat trading, which reflects the joyous celebration that emphasises wealth. During this session, blue-chip stocks—especially those in the Nifty 50—are frequently suggested for first-time investors. However, before investing in any firm, it is imperative to understand its basics. Things Traders Should Keep in Mind While muhurat trading is an exciting opportunity, it’s important to approach it with caution. The market can be volatile during this one-hour session, as all open positions will need to be settled.

Here are a few key points to consider:

1.Volatility: Markets often experience significant fluctuations during muhurat trading, so it’s vital to have a clear trading strategy.

2.Market Holiday: Trading occurs on a market holiday for Laxmi Pujan, and all equity and derivatives segments will be open during this hour.

3.High Trading Volume: Typically, trading volumes are high, driven by the festive mood, which can lead to quick price movements.

4.Liquidity Considerations: Ensure there is sufficient volume in the stocks you are trading. Some stocks may experience low liquidity, making it challenging to enter or exit positions.

5.Caution for New Traders: If you’re new to trading, it may be wise to observe rather than actively participate in muhurat trading due to its often unpredictable nature.

The high trading volumes and generally bullish sentiment make it an attractive period for investors. The festive atmosphere, focused on prosperity and wealth, tends to inspire optimism about the economy and the stock market.

As you prepare for this year’s muhurat trading, remember to research thoroughly and consider your investment goals. With the right strategy, you can seize the opportunities this auspicious trading session offers. Happy trading!